PM Kamyab Jawan Loan 2025

In 2025, the Government of Pakistan introduced the PM Kamyab Jawan Loan Program, a major step toward empowering youth and boosting entrepreneurship nationwide.

This initiative provides interest-free and low-interest business loans to young Pakistanis who want to start or expand their ventures — making it easier than ever to build financial independence and create jobs.

Why the PM Kamyab Jawan Loan 2025 Matters

Youth unemployment continues to be one of Pakistan’s biggest economic challenges. Every year, thousands of educated young people enter the job market — but many struggle to find work.

The PM Kamyab Jawan Loan Scheme 2025 aims to change this by turning job seekers into job creators through accessible financing and government-backed support.

Here’s what makes it so impactful:

- 💡 Financial Freedom: Start your business without relying on anyone else.

- 👩💼 Women Empowerment: Special quota and incentives for female entrepreneurs.

- 🧠 Support for Innovation: Focus areas include IT, agriculture, e-commerce, and services.

- 💰 Boost to Economy: New startups will create jobs and stimulate local economies.

From a tech startup to a small agricultural business — every idea now has a chance to succeed under this program.

Key Features of the PM Kamyab Jawan Loan 2025

| Feature | Details |

|---|---|

| Program Name | PM Kamyab Jawan Youth Loan 2025 |

| Loan Amount | Rs. 100,000 – Rs. 7.5 million |

| Interest Rate | 0% – 7% (based on tier) |

| Eligible Age | 21–45 years (18 years for IT/e-commerce startups) |

| Target Group | Students, unemployed youth, new entrepreneurs |

| Application Process | Online via official portal |

| Supervised By | State Bank of Pakistan & partner banks |

This flexible structure ensures that both new startups and existing small businesses can benefit equally.

Loan Categories & Repayment Plans

The program is divided into three easy tiers to suit different business sizes and needs:

| Tier | Loan Range (PKR) | Interest Rate | Repayment Duration |

|---|---|---|---|

| Tier 1 | Rs. 100,000 – Rs. 1 million | 0% | Up to 8 years |

| Tier 2 | Rs. 1 million – Rs. 5 million | 5% | Up to 8 years |

| Tier 3 | Rs. 5 million – Rs. 7.5 million | 7% | Up to 8 years |

This tiered structure ensures that every level of entrepreneur — from beginners to professionals — can apply confidently.

Eligibility Criteria

To apply for the PM Kamyab Jawan Loan, applicants must meet the following conditions:

- Must be a Pakistani citizen with a valid CNIC.

- Age: 21–45 years (minimum 18 years for IT or e-commerce startups).

- Must have a viable business plan or proposal.

- Fresh graduates, unemployed youth, and women entrepreneurs are highly encouraged to apply.

- Both new and existing small businesses are eligible.

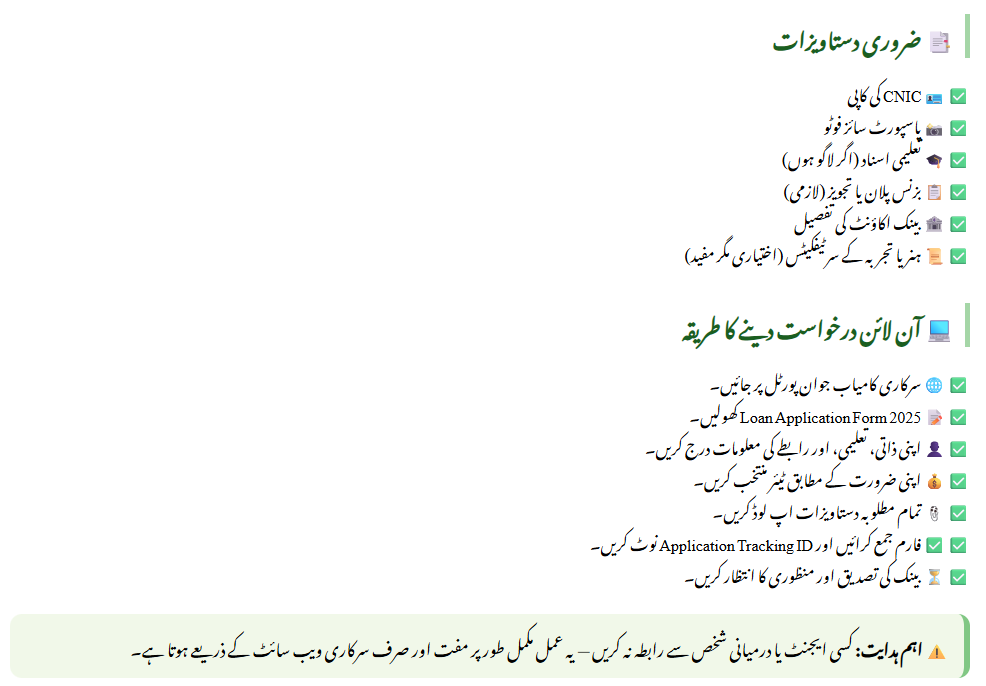

Required Documents

Before applying online, make sure you have the following:

- Copy of valid CNIC

- Passport-size photo

- Educational certificates (if applicable)

- Business plan or proposal (mandatory)

- Bank account details

- Skill/experience certificates (optional but recommended)

How to Apply Online for PM Kamyab Jawan Loan 2025

Follow these simple steps for a smooth application process:

- Visit the official PM Kamyab Jawan Portal.

- Open the Loan Application Form 2025.

- Enter your personal, contact, and educational information.

- Select your loan tier according to your business need.

- Upload scanned copies of all required documents.

- Submit the form and note your application tracking ID.

- Wait for bank verification and approval.

⚠️ Important Tip:

Beware of middlemen or agents — the process is completely free and done only through the official website.

Final Thoughts

The PM Kamyab Jawan Loan 2025 is a landmark initiative to empower Pakistan’s youth with financial tools for success.

With low-interest loans, long repayment periods, and government-backed support, young Pakistanis can now build sustainable businesses, create jobs, and contribute to the country’s growth.

Whether you’re a graduate with a startup idea, a farmer planning to modernize your tools, or a woman entrepreneur with a dream — this program is your gateway to success.

Apply today and take the first step toward a financially independent future.

FAQs (Frequently Asked Questions)

1. What is the PM Kamyab Jawan Loan 2025 program?

The PM Kamyab Jawan Loan 2025 is a government initiative to offer interest-free or low-interest business loans to young entrepreneurs and graduates, helping them start or expand their own businesses and fight unemployment.

2. Who is eligible for the PM Kamyab Jawan Loan?

Eligibility criteria include being a Pakistani citizen with a valid CNIC, aged 21-45 years (or 18+ for IT/e-commerce startups), presenting a credible business plan, and being an unemployed youth or skilled graduate. Female entrepreneurs receive special quota benefits.

3. How much can I receive through the Kamyab Jawan Loan?

You can receive a loan ranging from Rs. 100,000 up to Rs. 7.5 million, depending on the tier and nature of your business. Small startups typically qualify for Tier-1 (interest-free), while larger businesses may receive up to Rs. 7.5 million at a reduced interest rate.

4. What are the repayment terms for this loan?

The loan is structured over an 8-year repayment period with three different tiers:

Tier-1: Rs. 100,000 – 1,000,000 at 0% interest

Tier-2: Rs. 1,000,000 – 5,000,000 at 5% interest

Tier-3: Rs. 5,000,000 – 7,500,000 at 7% interest

5. How do I apply for the PM Kamyab Jawan Loan online?

Visit the official Kamyab Jawan portal, complete the online application form, upload your CNIC, business plan, and financial documents, select your loan tier, and submit the form. Approval typically follows bank verification within a few weeks.

Related Posts